Property and Casualty Agent Resources

Find information on all things flood insurance related, including key definitions, FAQs, and detailed guidance on specialized topics. With regularly updated information and tools tailored to insurance professionals, this section equips agents with the knowledge and resources needed to grow their flood insurance business.

Flood Insurance: How It Works

The National Flood Insurance Program

The National Flood Insurance Program (NFIP), established in 1968 by the National Flood Insurance Act, provides federally backed flood insurance to property owners, renters, and businesses in participating communities. Administered by the Federal Emergency Management Agency (FEMA), the NFIP was created to reduce the financial impact of floods by offering affordable coverage and encouraging communities to adopt and enforce floodplain management regulations.

Since the establishment of the NFIP, the private market rapidly expanded flood insurance options, providing property owners a cost-competitive alternative for this necessary disaster assistance.

Flood Insurance Requirements

If your client owns property in a Special Flood Hazard Area (SFHA) and they purchased their property with a loan from a federally regulated and insured lender, then they are required to carry flood insurance for the life of the loan.

Those located outside SFHAs can also purchase flood insurance and many lenders are now expanding their requirements into moderate-low risk areas.

Whether purchasing flood insurance for a property located in a SFHA or in a moderate-low risk area, you can shop for policies within the NFIP or on the private market.

Flood Insurance Basics

All properties are at some risk for flooding. Lenders and insurance providers use FEMA flood zone maps to determine the level of flooding risk, from low to high. Most homeowners policies do not cover flooding. Only a flood insurance policy will financially protect a property owner from the rising costs of flood damage. Flood insurance is available to homeowners, business owners, and renters for both a building/structure and its contents.

Contents Coverage: Why It's Important

What Is Content's Coverage?

Contents coverage in insurance refers to the protection provided for the belongings inside a home or business, covering items like furniture, electronics, clothing, and personal items. This type of coverage helps replace or repair your personal property if it’s damaged, destroyed, or stolen due to covered events.

When a flood happens, having contents coverage is just as important as coverage for the structure. Even a few inches of water can cause tens of thousands of dollars in damage. Contents coverage is an important option to consider because it's not automatically included in a standard flood insurance policy.

Is contents coverage required for property located in a SFHA?

Contents coverage is highly recommended considering the devastating affects of flooding on personal property. Property owners in SFHA designated zones and have a mortgage from a federally regulated lender are required to purchase flood insurance for the building/structure, but not for contents unless it is part of the collateral secured by the loan.

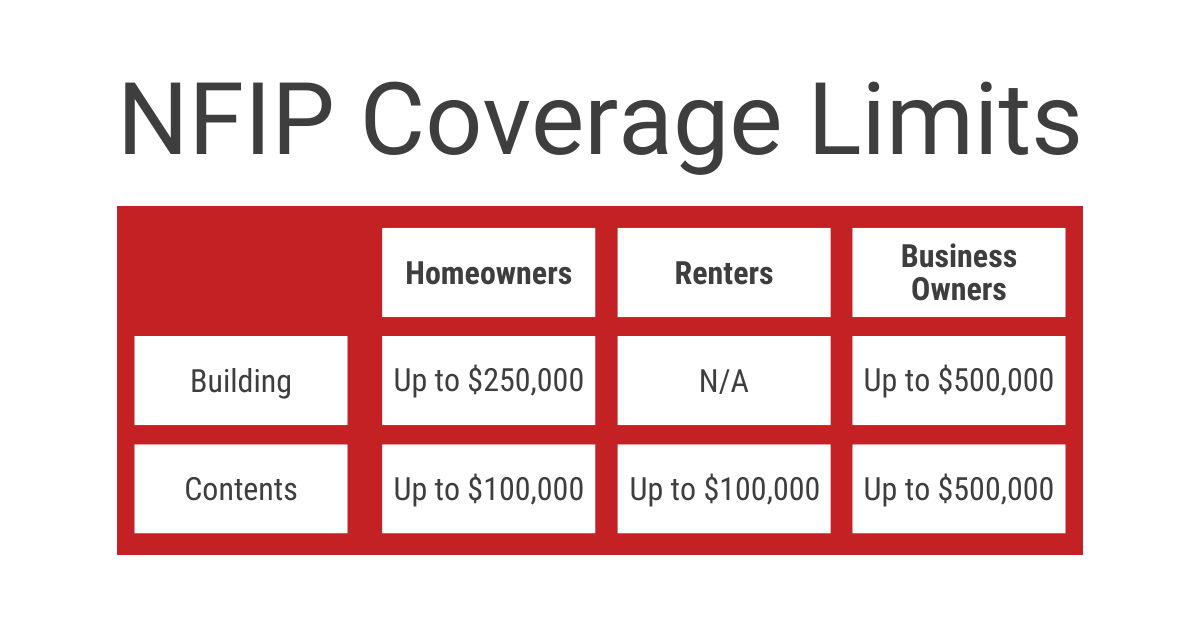

Under the NFIP, homeowners and renters can purchase personal property, also called contents coverage, up to $100,000. Business owners can purchase contents coverage up to $500,000.

Are There Lower Cost Options?

If a property is located in a low-to moderate risk area, the flood risk is greatly reduced and the property owner may be eligible for lower cost options from either the NFIP or the private market.

With the NFIP, they may consider a Preferred Risk Policy that can be customized to provide either building and contents coverage or just contents coverage.

What Could Be Lost in a Flood?

Contents coverage pays actual cash value for personal belongings lost in a flood. Homeowners could lose everything from large household appliances like televisions and refrigerators to small, hard to recover items, like children's toys and personal jewelry. Without contents coverage, the property owner could end up having to cover all those losses out of pocket.